us germany tax treaty summary

The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD.

How Does The Current System Of International Taxation Work Tax Policy Center

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in.

. Germany - Tax Treaty Documents. A protocol is an amendment to a treaty. It is important that you read both the treaty and the protocols that.

If you are treated as a resident of a foreign country under a tax treaty and not treated as a. The United States is a party to. German income tax rates are relatively high compared to the US so for many people it will make sense to claim the Foreign Tax Credit.

Each of these treaties follows. German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in.

This will be a major benefit to United States multinationals with investments or plans to invest in the Federal Republic of Germany. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability to 1300. The United States reserves the right except as provided in paragraph 5 to tax its residents and citizens as provided in its internal law notwithstanding any provisions of the.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double. A separate protocol and an accompanying joint.

United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. Four of the most important estate tax treaties to which the United States is a party - the treaties with France Germany the Netherlands and the United Kingdom.

The Effect of Tax Treaties. Residency for treaty purposes is determined by the applicable treaty. The treaty has been updated and revised with the most recent version being 2006.

United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income. 61 rows Summary of US tax treaty benefits. The purpose of the Germany-USA double taxation treaty.

Alongside income tax there is also a. If you have problems opening the pdf document or viewing. Convention between the United States of.

Germany and the United States have been engaged in treaty relations for many years. The complete texts of the following tax treaty documents are available in Adobe PDF format. Germany and the United States signed an income and capital tax convention and an accompanying protocol on August 29 1989.

This table also shows the general effective date of each treaty and protocol. The purpose of the. The United States Government and the.

Us Expat Taxes For Americans Living In Germany Bright Tax

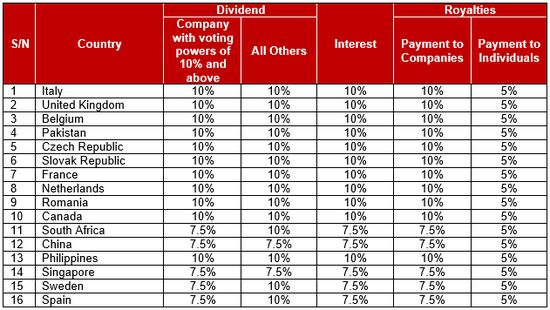

Minister Of Finance Approves Increase In Withholding Tax Rates Under Double Taxation Agreements Between Nigeria And Other Countries With Effect From 1 July 2022 Withholding Tax Nigeria

Nato Founders History Purpose Countries Map Facts Britannica

Germany The Treaty Of Versailles Britannica

Germany Usa Double Taxation Treaty

Joint Economic Committee Tax Hearing Build Back Better Revenue Items

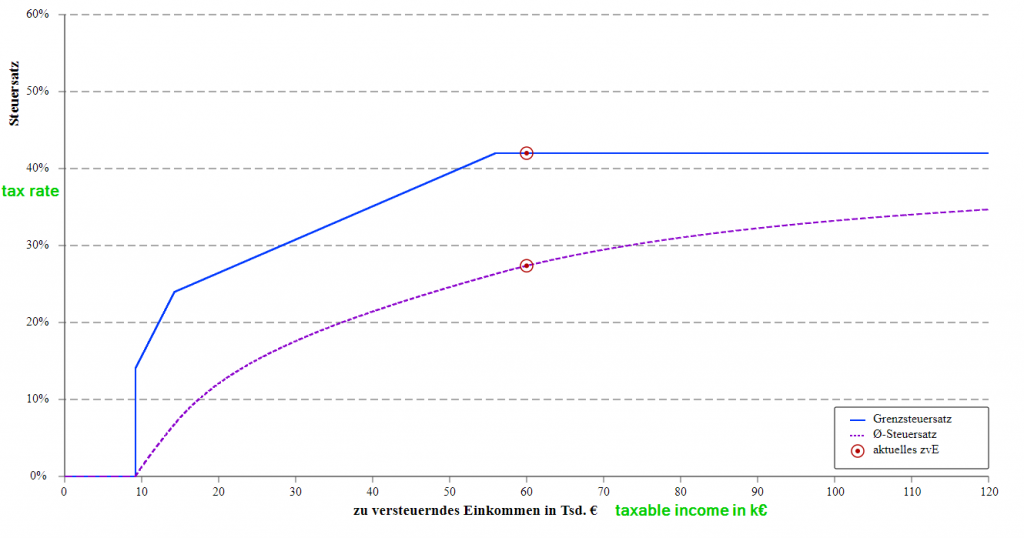

Faq German Tax System Steuerkanzlei Pfleger

Economic And Climate Benefits Of Electric Vehicles In China The United States And Germany Environmental Science Technology

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Spain Germany Sign New Tax Treaty Ernst Amp Young T Magazine

:max_bytes(150000):strip_icc()/dotdash-brief-history-international-trade-agreements-v2-2d7ef50e8498475e927985609a9d0308.jpg)

A Brief History Of International Trade Agreements

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Dentons Global Tax Guide To Doing Business In Ecuador

Germany Taxation Of International Executives Kpmg Global

Federal Insurance Contributions Act Wikipedia

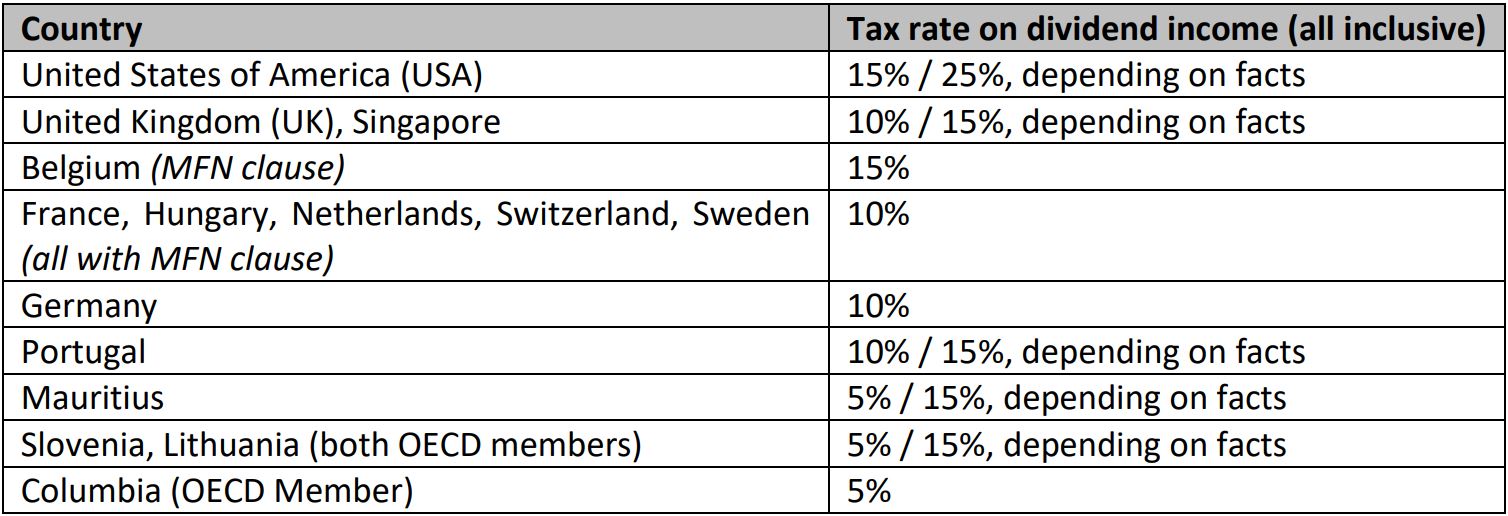

Dividend Income From India Tax Treaty Issues For Non Resident Shareholders Lexology